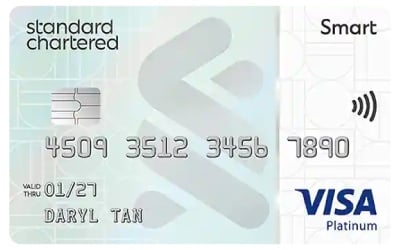

Standard Chartered Smart Credit Card Review

To justify genuineness of your review kindly attach purchase proof. 1st year annual fee waived subsequent years waived with minimum spend of RM12000 per annum.

Standard Chartered Bank Smart Visa Credit Card Review Genx Geny Genz

Welcome Offer is from from 6 July 2021 to 7 July 2021.

Standard chartered smart credit card review. New Cardholders are applicants who do not currently hold and have not cancelled any principal card of Standard Chartered Credit Card or MANHATTAN Credit Card issued by Standard Chartered Bank Hong Kong Limited the Bank in the past 6 months from the date of approval of their current applications for a. Read our full review Earn up to RM 50 cashback every month on your online purchases and digital lifestyle spends with a Smart Credit Card. 1143 thoughts on New Launch.

Indulge in a food feast for up to 50 OFF. Live play and shop smart with Standard. Smart Card Welcome Offer.

Standard Chartered Bank just introduced a new credit card called SMART. Standard Chartered Smart Credit Card offers a very high 5 cashback on transactions at select merchants like Watsons and PARKnSHOP which is one of the highest rebates on the market. It is a viable option if you frequently use Myntra Ola Yatra BookMyShow and other merchants mentioned above.

The Smart credit card by Standard Chartered offers 6 cashback for the following seven digital. Other transactions with non-designated merchants earn 056 cashback which is higher than the 04 offered by many competitorsThe Smart Credit Cards perpetual annual fee waiver and a low. Win at life with Standard Chartered Smart credit card and earn up to RM50 cashback per month.

One thing for sure Standard Chartered Bank and HSBC credit cards are kind of complicated so they are only good for smart people where they have this and that conditions applied in order to earn cash back unlike our local GLC banks cash back credit cards which are straight forward and guarantee that we earn. One thing for sure Standard Chartered Bank and HSBC credit cards are kind of complicated so they are only good for smart people where they have this and that conditions applied in order to earn cash back unlike our local GLC banks cash back. Standard Chartered DigiSmart credit card is a beginner level credit card that comes with a monthly fee of just Rs49.

Besides that you will also get to enjoy 0 pa. But if you do not use these merchants then this card may not be of much use to you. Interest on Cheque-on-Call Plus with up to RM15000 for 12 months.

Applicant should belong to credit cards sourcing citieslocations of the Bank. All applications are subject to credit and other policy checks of the Bank. I hope they give it under LTF offer or annual fee reversal offer.

An existing client of the bank holding any other Standard Chartered credit card will not be eligible to apply for the card and if such application is made the bank shall reject the same. Standard Chartered Bank just introduced a new credit card called SMART. Standard Chartered Smart credit card fees and charges.

Read the Smart Credit Card 30 Cashback Campaign Terms Condition here. Then it can be a perfect secondary or infact the main credit card to use. You cant directly apply for the Standard Chartered Digi Smart Cardthe only way to get the card is to upgrade your existing credit credit card from Standard.

Wearable Devices Smart Watches Fitness Bands. Standard Chartered Platinum Credit Card Review 2021. It is also Malaysias first carbon-neutral card thanks to offset emissions in the production process.

Standard Chartered Rewards Card is a great supplementary card for consumers with a specialised primary cardsuch as a shopping cardwho would like to maximise rewards for dining and overseas expenses beyond the base rate provided by the primary card. Home Personal Finance Credit Cards Standard Chartered Visa Credit Card Standard Chartered Visa Credit Card Follow Following Share. Standard Chartered has launched the new Standard Chartered Smart Credit Card a cashback credit card designed for digital lifestyle expenditure.

If you are applying for a credit card for the first time and have doubts about approval due to low incomesalary then you must apply for SC. Not only that if you order your food online you also get to receive up to 50 OFF from your total bill. With the Standard Chartered Smart Credit Card enjoy up to 30 OFF when you swipe your card at selected restaurants.

The all-new Standard Chartered Smart Credit Card is here for online shoppers streamers gamers foodies and music lovers with up to RM 100 cashback up for grabs. August 25 2020 by Pardeep Goyal. Standard Chartered Smart Credit Card is equipped with beneficial credit lines such as Flexi Pay Plus and Balance Transfer Plus which offer competitive rates and flexible repayment tenures.

Standard Chartered Platinum is an entry-level rewards credit card best for the first time applicant. Standard Chartered Ultimate Credit Card Review Prashant Gupta September 19 2017.

Standard Chartered Digismart Credit Card Review 02 July 2021

Smart Credit Card Smart Card Standard Chartered Hk

6 Reasons Standard Chartered Smart Credit Card Is Good For Millenials

Smart Credit Card Up To Rm100 Cashback Standard Chartered Malaysia Standard Chartered Malaysia

Standard Chartered Launches Smart Credit Card Malaysia S First Carbon Neutral Card

Standard Chartered Smart Credit Card 6 Cashback For Digital Subscription

Standard Chartered Digismart Credit Card Review Chargeplate The Finsavvy Arena

Smart Credit Card Up To Rm100 Cashback Standard Chartered Malaysia Standard Chartered Malaysia

Standard Chartered Smart Credit Card Is It The Best Choice For You Valuechampion Hk

Stanchart Digismart Credit Card Review Credit Cardz

Standard Chartered Digismart Credit Card Launched Cardinfo

Posting Komentar untuk "Standard Chartered Smart Credit Card Review"