Standard Chartered Smart Credit Card Annual Fee

Standard Chartered Bank has launched its all-in-one credit card- the DigiSmart Card. As you gain more reward points you can redeem them for a wide variety of vouchers gift cards and much more.

Standard Chartered Bank Smart Visa Credit Card Review Genx Geny Genz

Learn more about Standard Chartered FlexiPay Plus Fees Charges Annual Fee.

Standard chartered smart credit card annual fee. The total amount charged was S19260. With Standard Chartereds Platinum Rewards credit card you can earn reward points for every INR 150 you spend to make a purchase either online or offline making it the best credit card for the same. For the Standard Chartered Smart Credit Card there is an annual fee of RM120 for the principal card but for supplementary cardholders there is no annual fee.

Rewards on local spend 5 Cashback. Standard Chartered FlexiPay Plus Learn more about Standard Chartered FlexiPay Plus. Personal Instalment Loan.

RM0 primary card. Standard Chartered FlexiPay Plus lets you enjoy a payment term of up to 18 months at 988 interest rates per annum with minimum spending of RM500. It is a viable option if you frequently use Myntra Ola Yatra BookMyShow and other merchants mentioned above.

The card charges a monthly fee of Rs. Select the applicable fee to be waived. Select an applicable credit card with annual fee charged.

Interest Rate On Cash Withdrawals. Annual Fee Waiver Perpetual. Annual Salary HK 96000.

Credit Cards with Annual Fee that Cannot Be Waived. Pick the credit card that suits your needs the most and get the annual fee waiver hotline short keys to save your time. Welcome Offer - Up to HK1500 CashBack HK1000 CashBack for spending HK500 CashBack for recurring transactions The welcome offer is only applicable to New Cardholders who submit the Standard Chartered Smart Credit Card application through online channel from 1 April to 5 July 2021 and fulfill relevant requirements.

Loans Back Personal Loans. Standard Chartered Smart credit card fees and charges. Standard Chartered DigiSmart credit card is a beginner level credit card that comes with a monthly fee of just Rs49.

49 instead of annual fee and it is waived off on. Apply now to get extra HK350 Supermarket Voucher on top of welcome offer of up to HK1600 CashBack. Standard Chartered Smart Card.

Standard Chartered Credit Cards With No Annual Fees Let us get started with this article now and checkout the Standard Chartered credit cards with no annual fees. Earlier this month while Mr Budget routinely checks his credit card transaction he realised that Standard Chartered has charged him the annual fee for the usage of the Standard Chartered Unlimited Cashback card. Principal Card annual fee RM120.

However from past records SCB and HSBC suka-suka change the. For the first year the annual fee will be waived as long as you have a minimum spending of RM12000 annually. Designed to suit the needs of those who do most of the shopping online this credit card offers multiple benefits on shopping travel dining movies and grocery purchases.

Enjoy annual fee waiver and earn rewards with Standard Chartered credit cards some credit cards even offer a perpetual annual fee waiver to save you the hassle. Annual Fee For Supplementary Card. Income RM3000 month Annual Fee.

An existing client of the bank holding any other Standard Chartered credit card will not be eligible to apply for the card and if such application is made the bank shall reject the same. But if you do not use these merchants then this card may not be of much use to you. So these are the 3 Standard Chartered credit cards with no annual fees now you can apply for these cards.

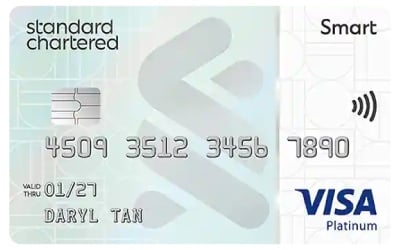

Standard Chartered Smart Credit Card Enjoy 3-month Interest-free Instalment for unlimited retail purchases. Standard Chartered Visa Platinum Min. RM 10 or 1 of the outstanding amount whichever is higher subject to a maximum of RM 100.

Is there an annual fee for Standard Chartered Smart Credit Card. Smart Business Account. Instead clients will be charged a modest sum of INR 49 per month.

Enjoy 0 subscription fee for online trades. Sales and Service Tax RM25 on each principal and supplementary card upon activation and anniversary date Minimum Monthly Payment RM50 or 5 of outstanding amount whichever is higher Late Payment Fee RM10 or 1 of outstanding amount up to. Click on Credit Card Fee Waiver.

Standard Chartered Smart Credit Card Min. Compare and find the best no annual fee credit cards and earn up to 8 cashback or 5x reward points. Income RM3000 month Annual Fee Free Cashback up to 30.

As usual SCB credit cards are not FREE. If you do the math you will realize that the amount is actually quite a huge amount. Choosing a Standard Chartered card with no annual fee does not mean you cant enjoy the perks that come with owning a credit card.

1st year annual fee waived subsequent years waived with minimum spend of RM12000 per annum. The first year annual fee is waived and the subsequent years waived with minimum spend of RM12000 per annum. RM 50 or 5 of the outstanding amount whichever is higher.

The DigiSmart credit card has no annual fee.

Smart Credit Card Up To Rm100 Cashback Standard Chartered Malaysia Standard Chartered Malaysia

Standard Chartered Digismart Credit Card Offers Fees Charges 09 July 2021

Standard Chartered Digismart Credit Card Launched Cardinfo

Standard Chartered Smart Credit Card 6 Cashback For Digital Subscription

Smart Credit Card Smart Card Standard Chartered Hk

Standard Chartered Launches Smart Credit Card Malaysia S First Carbon Neutral Card

Standard Chartered Smart Credit Card Is It The Best Choice For You Valuechampion Hk

Smart Credit Card Up To Rm100 Cashback Standard Chartered Malaysia Standard Chartered Malaysia

Standard Chartered Digismart Credit Card Review 02 July 2021

6 Reasons Standard Chartered Smart Credit Card Is Good For Millenials

Standard Chartered Digismart Credit Card Review Chargeplate The Finsavvy Arena

Posting Komentar untuk "Standard Chartered Smart Credit Card Annual Fee"