Sales Tax Exemption In Malaysia

The government has extended the Sales and Services Tax SST exemption for passenger vehicles for six months until June 30 next year. Exported manufactured goods will be excluded from the sales tax act.

Sales Tax Exemption Toyota Updates Price List For Malaysia Autobuzz My

The Ministry of Finance Malaysia through a late evening television broadcast has announced that the sales and service tax SST exemptions period that was set to expire on 30th of June 2021 will be extended to the 31st December 2021.

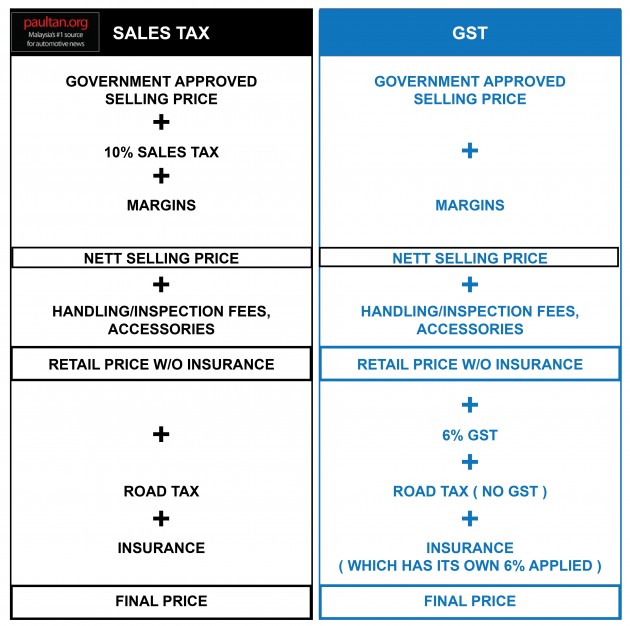

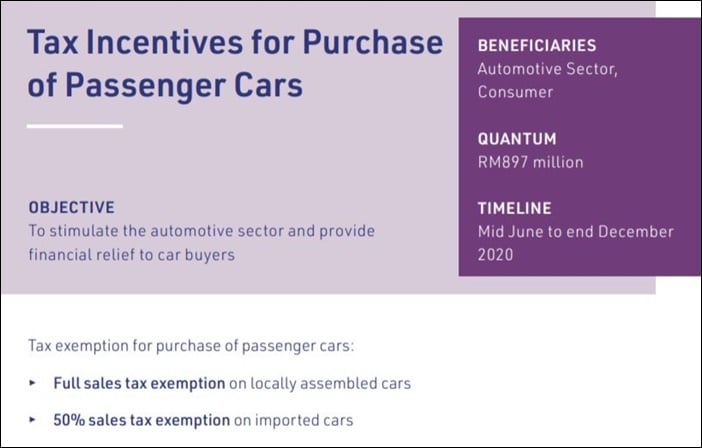

Sales tax exemption in malaysia. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018. Jun 8 2020 1212 AM As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent.

Manufacturing activities which are exempted by Minister of Finance under Sales Tax Exemption From Registration Order 2018. A taxable period is a period of 2 calendar months however a taxable person can apply to the DG of Customs to vary the taxable period. Under the Sales Tax Act 2018 sales tax is charged and levied on imported and.

A Application for MIDA Confirmation Letter Surat Pengesahan MIDA SPM for Import Duty andor Sales Tax Exemption B Import Duty and Sales Tax Exemption on Machinery and Equipment for Selected Activities in Agriculture Sector. The sales tax rate is at 510 or on a specific rate or exempt. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

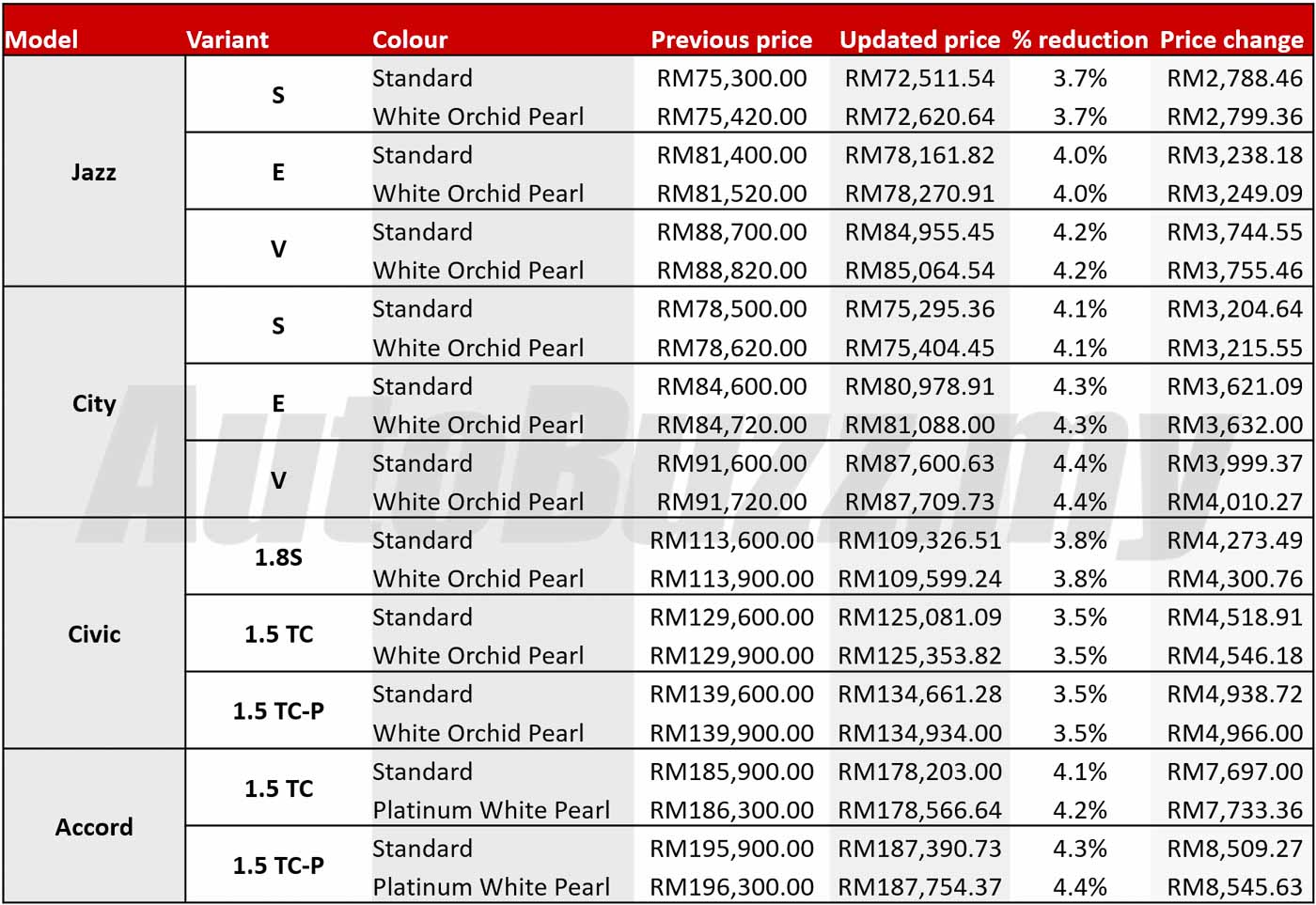

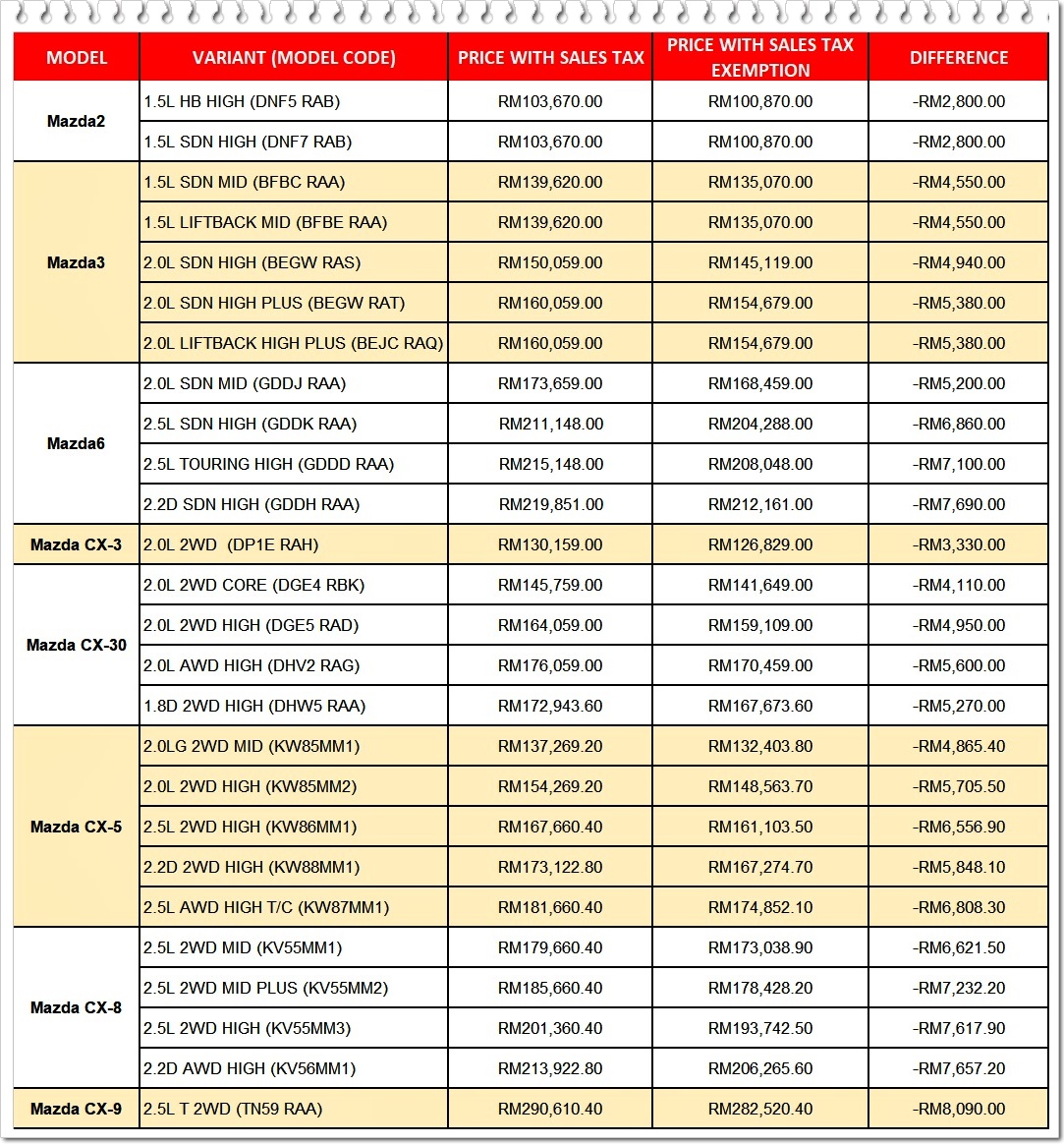

The sales tax exemptionreduction is applicable from 15-June to 31-December 2020. The move was made back then in anticipation of the re-implementation of the sales and services tax SST. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the Sales Tax which are meant for export and also on control items under the Ration Control Act 1961 which is bound under the price control to get taxed raw materials including packaging.

The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence. In a letter seen by the New Straits Times Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz had agreed to the extension from January 1 until June 30 2021 under the Penjana economic recovery. Sales tax exemption expansion The Sales Tax Persons Exempted from Payment of Tax Amendment No2 Order 2020 was published in the official gazette on.

Exempt goods and goods taxable at 5 are defined by the HS tariff code of the goods as prescribed in a gazette order. Goods and Person Exempted from Sales Tax - SST Malaysia Goods and Person Exempted from Sales Tax This page is also available in. Any sales tax that falls due during a taxable period is payable to the Royal Malaysian Customs Department RMCD latest by the last day of the month following the end of the taxable period.

Effective from 1 September 2018 Sales Tax Act 2018 and the Service Tax Act 2018 together with its respective subsidiary legislations are introduced to replace the Goods and Service GST Act 2014. Sales tax exemption for certain petroleum sector goods 17 June 2021 Amendments to the sales tax rules concern an exemption for certain taxpayers involved in. However at the same time not.

Melayu Malay 简体中文 Chinese Simplified Goods and Person Exempted from Sales Tax. According to the memo the percentage of sales tax exemption. Malaysia excludes designated area and special area.

The sales tax exemption is fundamentally similar to the tax holiday that Malaysians enjoyed between June to August 2018 during which the goods and service tax GST was zero-rated from all vehicle prices. The sales tax exemption which has been in place since June 15 was originally scheduled to come to an end on December 31 this year. The sales tax for vehicles in Malaysia is currently set at 10 for both locally assembled and imported cars so the exemption means that the sales tax is fully waived for locally assembled cars and charged at 5 for imported cars.

You can refer to our article for a deeper look at how much you would save thanks to the sales tax exemption. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Such exemption is granted in the Sales Tax Exemption from Licensing Order 1972.

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Paultan Org

Sales Tax Exemption Honda Malaysia S Revised Price List Autobuzz My

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

Revised Mazda Prices With Sales Tax Exemption From June 15 2020 News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Mazda Prices Revised Based On Sales Tax Exemption In Malaysia Autoworld Com My

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Car In My Life

Https Mysst Customs Gov My Assets Document Apply 20exemption 20schedule 20c5 How Pdf

Goods And Person Exempted From Sales Tax Sst Malaysia

Government Extends Sst Exemption Period Again To Dec 31 2021 100 On New Ckd Cars 50 For Cbu Paultan Org

Sales Tax Exemption Toyota Updates Price List For Malaysia Autobuzz My

Posting Komentar untuk "Sales Tax Exemption In Malaysia"