Sales Tax In Malaysia

Sales tax is a single-stage tax charged and levied. With effect from 1 January 2019 registered manufacturers are able to apply to the DG of Customs for the following amount of sales tax deduction on the taxable raw materials components or packaging materials acquired from local traders and used solely in the manufacturing of their taxable goods.

Gst Is Not New The Concept Behind Gst Was Invented By A French Tax Official In The 1950s In Some Countries It Is Known As Vat Or Value Added Tax Today More Than 160 Nations Including The European Union And Asian Countries Such As Sri Lanka

SST is administered by the Royal Malaysian Customs Department RMCD.

Sales tax in malaysia. Note that the sales tax makes up 10. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. On taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed off.

Malaysia is to reintroduce its Sales and Services Taxes SST from 1 September 2018 with a likely standard rate of 10. Imposition of Sales Tax 4. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia.

The Sales Tax a single stage tax was levied at the import or manufacturing levels. Service tax a consumption tax levied and charged on any taxable services provided in Malaysia by. However at the same time not.

Payment by instalments 33. Service Tax Policy No. On taxable goods manufactured in Malaysia by a taxable person and sold by.

Panduan Pembayaran Balik Refund Pulang Balik Drawback dan Rayuan Cukai Jualan Malay Version ONLY More 31052021. On taxable goods imported into Malaysia. Exported manufactured goods will be excluded from the sales tax act.

FREQUENTLY ASKED QUESTIONS FAQ - Sales Tax 2018 SALES TAX 1. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. Goods subject to customs or excise control not to be.

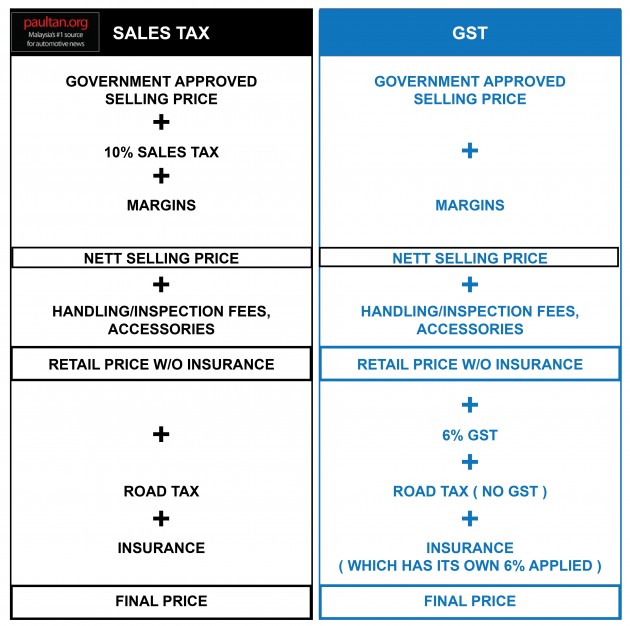

Sales tax deduction. Sales tax in Malaysia is a single-stage tax imposed at the manufactures level. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

The raw material or components use in the manufacture of taxable. Facilities Under The Sales Tax Act 1972. Recovery of sales tax etc from persons about to leave Malaysia without paying sales tax etc.

For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model. Power to collect sales tax etc from person owing money to taxable person 30. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally.

What is sales tax. GST was only introduced in April 2015. Sales tax is a single-stage tax charged and levied.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. Sec 81 Sales Tax Act 2018 A tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in Malaysia by a registered manufacturer and sold used or. Government collects Sales Tax at the manufacturers level only and the element of sales tax embedded in the price paid by the consumer.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are sold or disposed of.

Sales Tax Person Exempted From Payment Of Tax Amendment Order 2021. The Sales Tax is being reimposed to reassure financial markets that the country can cope with the lose of the GST revenues The planned high-speed railway link to Singapore has already been cancelled because of fiscal concerns. Remisi Penalti GagalLewat Bayar.

In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018. What is sales tax. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. The sales tax rate is at 510 or on a specific rate or exempt. Recovery of sales tax before payable from persons about to leave Malaysia 31.

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia. Service Tax Policy No. Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods.

If you want to take advantage of the tax cut heres a list of cars assembled in Malaysia for your reference.

Sst Simplified Malaysian Sales Tax Guide Mypf My

Goods And Services Tax Malaysia Gst Ts Mohd Nur Asmawisham Bin Alel

Sst Simplified Malaysian Sales Tax Guide Mypf My

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

A Guide To Gst In Malaysia How Does It Affect Me

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Goods And Person Exempted From Sales Tax Sst Malaysia

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Paultan Org

Posting Komentar untuk "Sales Tax In Malaysia"